by Giacomo Bortolazzi (Italy Team) & Marco Verrocchio (Military Strategy & Intelligence Team)

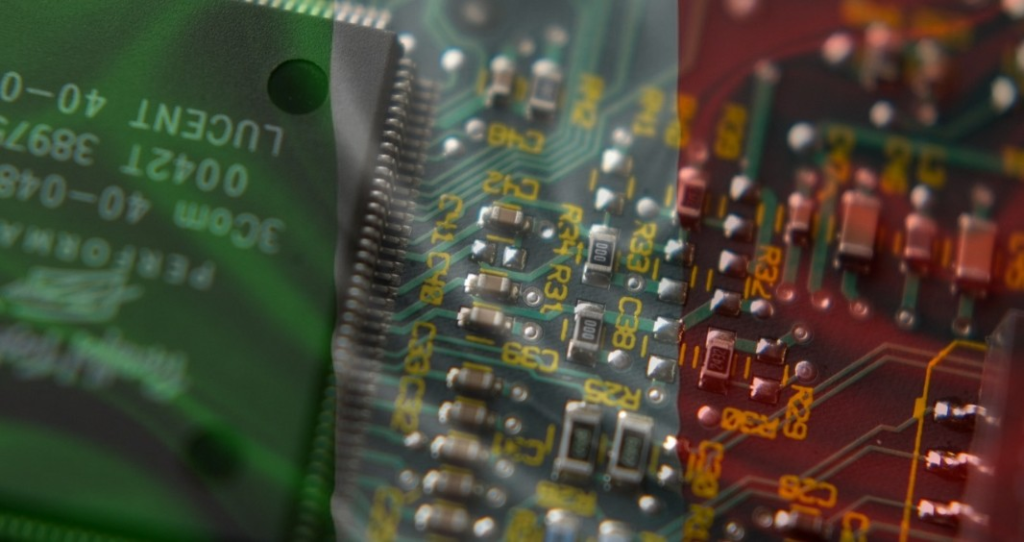

Despite the relative overcoming of the crisis sparked in early 2020, the global shortage of semiconductor chips has precipitated countries and companies into fierce competition on a global scale. This paper examines the potential response of Italy and its strategic initiatives in one of the most strategic issues in the near future. Nonetheless, Italian initiatives are propelled and integrated into the European framework of the Chips Act. By analysing Italy's alignment with the EU's objective, the article provides insights into the nation's efforts in the complex global semiconductor landscape.

Semiconductors' crisis: Europe's role in the global Chip shortages

The world is not new to the fierce competition among countries on semiconductors. However, the demand for cutting-edge technologies and the massive need for semiconductors in everyday life smart devices are determining insecurities on the endurance of the GVCs. The global chip shortage during the Covid-19 pandemic has drawn the attention of industries and states on the strategic value of semiconductors. While supplies of chips began to improve in 2022, the already high demand for advanced chips, such as those for the automotive and military sector, is continuing to intensify: the global market of semiconductors is projected to scale from $573.44 billion in 2022 to $1,380.79 billion by 2029 at a compound annual growth rate of 12.2%. However, chips are not so easy to make: While building factories and clean laboratories requires years, transforming a single silicon wafer into semiconductors takes months. Based on said high demand and the complexity of making semiconductors, the latter’s GVCs are highly amenable to geopolitical tensions such as the US-China trade competition. For these reasons, governments are investing to boost domestic production, attract foreign investment, and discourage the export of semiconductor technologies.

While Japan and the US dominated semiconductor manufacturing in the 90s, today Taiwan and South Korea are leading the market both in terms of volume and of production of the smallest nanometer chips. The eruption of the US-China trade competition and the shortage of chips during the Pandemic, on the other hand, led the US and Japan to adopt policies against the exports of chips-related technologies, encouraging the establishment of factories in the homeland. In this scenario, in July 2023 the EU adopted the European Chips Act, a regulation aimed at strengthening the European semiconductor market through more than €43 billion of investments. Based on the premises of the Chips Act, in the same year the regulation was implemented by the Chips Joint Undertaking (Chips JU), a call for funding based on public-private partnership to bridge the gap between R&D and the market.

The Italian implementation of the Chips Ju

Among the several European countries that became an active implementer of the Chips Joint Undertaking, Italy certainly represents an actor with an important burden on its shoulders. The first active participation of the country in the JU was in November 2023, when Chips.IT, the new Italian Centre for the Design of Semiconductor Integrated Circuits, and the Italian strategy for microelectronics were presented in Pavia. The two novelties are strongly intertwined: Chips.IT was born as part of the strategy to coordinate and strengthen the microchip design sector with state-of-the-art equipment, all in order to foster an overall development of the sector. The role of public and private entities was also stressed, with €225 million being allocated and big firms such as Intel, Sony, Infineon and the Italian STMicroelectronics willing to collaborate.

The national efforts in the field of the JU will also foster the birth of further projects that will have a positive impact on the national landscape: after the approval of the Governing Board of the JU, a new advanced microelectronics infrastructure was set up in the middle of the Etna Valley with the main task to build prototype devices for the development of innovative applications in the field of electric mobility and telecommunications. The initiative was strongly supported by the Italian Ministries of Enterprise and Made in Italy, the University and Research Ministry and the Ministry of Economy and Finance (MEF) and received an allocation of €360 million to be divided between the European Union and the participating states (namely Finland, Poland, Sweden, Austria, France and Germany). This investment will certainly have a positive impact on the area by fostering employment, newly established activities and a general blooming of the industrial sector directly related to microelectronics.

Another important presence in the Italian landscape will be that of Silicon Box, a Singaporean tech giant has planned to invest €3.2 billion in the Italian microelectronics industry with a new plant located in Novara. The role of this company is certainly not to be underestimated, as it could contribute to the Italian role in the market of the so-called “chiplets”. Sehat Sutardja, one of the founders of Silicon Box, introduced this concept in 2015 as an innovative and performance-enhancing technology. A chiplet is in fact a processor with multiple cores that is printed on the same layer with other chiplets: this would consent a more efficient communication, thus erasing the issue of hardware-software data transfer.

Italian expectations in the EU scenario

In a nutshell, Italy does not dispose of forgeries equiparable to those of countries such as China, which can hold entire GVCs inside their territory. Even though small enterprises are common in the Italian tech sector, many new important initiatives such as those started in the Etna Valley and in

Novara can be considered as holding a great potential. At the same time, the European Union has realised the importance and the scarcity of semiconductors and of the materials needed to produce it. Due to the important influx of investments received by Member States, Italy has experienced positive spillover effects, resulting in the transfer of valuable know-how and the creation of more job opportunities. In light of these novelties, the future possibility for Italy to start a “solo project” and to become itself a global actor is not to be excluded. Still, it’s important to bear in mind that key global actors such as South Korea, China or Taiwan are still a long way ahead and that multiple efforts will be required to launch Italy among the stars. Still, Italian efforts to be imprinted in the global semiconductor market are slowly revealing their “dual use”: they’re helping the European Union to reduce its dependency on external actors while securing the country’s competitiveness in the field of semiconductors.